Explain the actual referendum language on the November ballot.

Explain the actual referendum language on the November ballot.

The referendum ballot language is established by Indiana law and approved by the Indiana Department of Local Government Finance.

The language in the November 2023 referendum was passed by state legislators in the spring of 2021 in an effort to mislead voters and take away local control. It uses a formula that does not correctly reflect the continuation of a reduced tax rate.

The referendum ballot as approved reads:

“Shall Hamilton Southeastern Schools continue to impose increased property taxes paid to the school corporation by homeowners and businesses for eight (8) years immediately following the holding of the referendum for the purpose of funding academic and educationally related programs, maintaining class sizes, retaining and attracting of teachers, essential safety initiatives, and changing the previously approved maximum referendum tax rate from $0.2275 to $0.1995? The property tax increase requested in this referendum was originally approved by the voters in May, 2016 and if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 20.8% and if extended will increase the average property tax paid to the school corporation per year on a business property within the school corporation by 20.8%.”

While this ballot language should provide transparency for the voter, it ends up creating confusion and misinformation. Voting “YES” for this question means that the current school funding continues without any changes. The referendum tax rate would be reduced from 22.75¢ to 19.95¢ and will not increase taxes. The effect of this ballot question is very simple – Hamilton Southeastern (HSE) Schools funding will remain stable and in 2024 the impact of the referendum to homeowner tax bills will decrease by 19.1%.

Breaking down the ballot language, the first part reads, “Shall the Hamilton Southeastern Schools continue to impose increased property taxes paid to the school corporation by homeowners and businesses for eight (8) years immediately following the holding of the referendum…” As of 2021, the Indiana legislature requires the use of this language. The word “increased” is required to be included by the legislature even though this referendum is a decrease of the existing referendum rate.

The second part reflects the purpose of the referendum funding for the next eight years:

“…for the purpose of funding academic and educationally related programs, maintaining class sizes, retaining and attracting of teachers, essential safety initiatives, and changing the previously approved maximum referendum tax rate from $0.2275 to $0.1995?” This language was written by HSE Schools based on the Revenue Spending Plan approved by the HSE Board of Trustees. School districts must review and approve a plan annually. Referendum fund spending is audited to this plan by the State Board of Accounts. The current ballot language no longer includes information about the maximum tax rate. The school included it in this section to accurately reflect the reduction of the maximum rate passed in 2016.

The next section is required by the legislature as of 2021 and does not accurately reflect the referendum tax effect. “The property tax increase requested in this referendum was originally approved by the voters in May, 2016 and if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 20.8% and if extended will increase the average property tax paid to the school corporation per year on a business property within the school corporation by 20.8%.”

The formula HSE Schools was required to follow for the percentages of the tax effect is not an accurate representation for several reasons. There is no information allowed on the ballot concerning the effect of the renewal of the referendum. Averages of overall taxing district rates and assessed values are distorted in the formula and are not truly representative of the taxpayer base. The actual change to the impact of the referendum to an average median value home in 2023 will decrease by 19.1%. For a home in Fishers, this represents a 2.2% reduction of their overall tax bill, not a 20.8% increase as is implied.

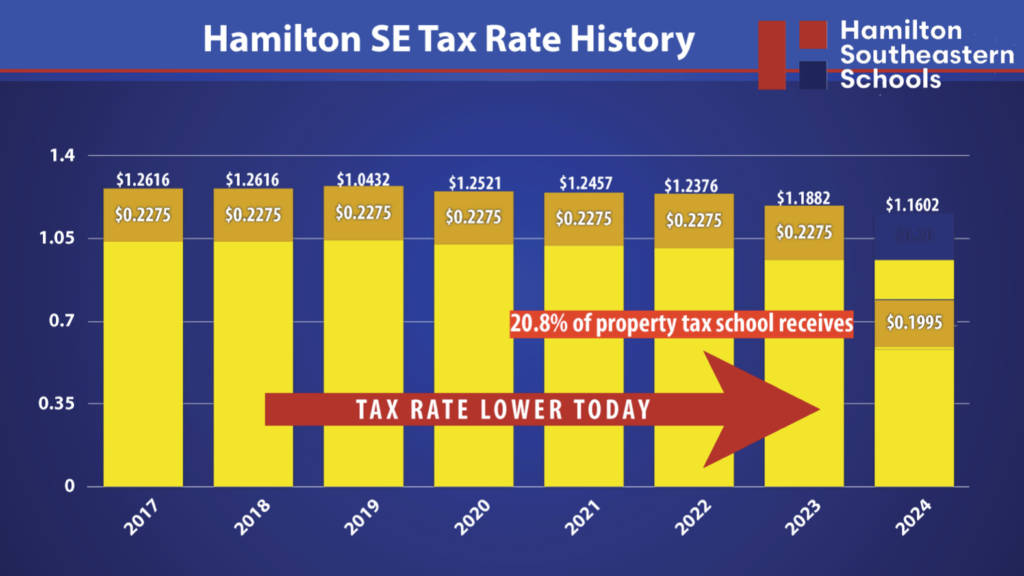

HSE Schools’ tax rate, other than the operating referendum, decreased over the last six years, as shown in this chart. The chart shows the school district was able to lower the other property taxes (Yellow) because of the flexibility provided by the referendum money (Gold). The “20.8%” in the ballot question is calculated as a percentage of the funding the school is receiving compared to the funds other than the referendum funding. It is not a 20.8% increase to the taxpayer. In 2023, the property taxes other than the referendum (Yellow) are calculated at a rate of 96.07¢. The referendum rate of 19.95¢ is 20.8% of those funds the school receives through the regular property taxes. In the chart, the referendum rate (Gold) has been moved to show it is one-fifth of the other taxes (Yellow).The actual formula required to certify the percentage in the ballot is spelled out by the Department of Local Government Finance and involves a calculation based on the mean average assessed value of a home in 2023 and an average of all the eight overall tax rates in the HSE district inclusive of all the other government entities.

Overall, the tax rate for schools is lower than it was before the referendum was passed. If the assessed value stays the same, the tax impact of the referendum will decrease between 19.1% to 12.3%, depending on increased deductions allowed by the state. However, if the assessed value goes up, the yellow portion will also drop and be less than it is now. For a commercial property in the HSE district the impact will be a reduction of 12.3%.