FAQs

A school corporation may conduct a referendum to create a property tax levy for the purpose of supplementing the revenue it receives from the state funding formula. The Hamilton Southeastern Schools (HSE) Board of Trustees passed a resolution that states the proposed referendum would be used to supplement existing revenues received from the state of Indiana for the purpose of managing class sizes and essential health and safety initiatives, retaining teachers and staff, and funding academic and educationally related programs.

An operating referendum creates an additional levy that goes into a special fund titled the “referendum fund” for a period not to exceed eight years. However, a referendum tax rate may be re-imposed or extended under the law if approved by the voters of the district.

The reduced-rate referendum is a renewal of a referendum passed by voters in the HSE district in 2016. In order to renew the referendum, Indiana law requires HSE Schools to hold a new election. The maximum tax rate on the November 2023 ballot is reduced by over 12% from the maximum rate in 2016. On or before November 7, 2023, voters registered in the HSE school district will be voting to extend the referendum for up to another eight years.

The referendum revenue is collected by the county through the property tax bills of property taxpayers in the school district. The money does not pass through the state but goes directly to the school district for the purposes of supplementing the education and operation funds of the school corporation. The education fund pays for faculty and staff.

The referendum is only on the ballot of voters registered to vote in the HSE district, which includes three townships: Delaware, Fall Creek, and Wayne. Registered voters living outside of the HSE district will not be voting on the referendum. The referendum tax rate will continue only if the ballot question receives a “YES” vote from the majority of voters.

Explain the actual referendum language on the November ballot.

The referendum ballot language is established by Indiana law and approved by the Indiana Department of Local Government Finance.

The language in the November 2023 referendum was passed by state legislators in the spring of 2021 in an effort to mislead voters and take away local control. It uses a formula that does not correctly reflect the continuation of a reduced tax rate.

The referendum ballot as approved reads:

“Shall Hamilton Southeastern Schools continue to impose increased property taxes paid to the school corporation by homeowners and businesses for eight (8) years immediately following the holding of the referendum for the purpose of funding academic and educationally related programs, maintaining class sizes, retaining and attracting of teachers, essential safety initiatives, and changing the previously approved maximum referendum tax rate from $0.2275 to $0.1995? The property tax increase requested in this referendum was originally approved by the voters in May, 2016 and if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 20.8% and if extended will increase the average property tax paid to the school corporation per year on a business property within the school corporation by 20.8%.”

While this ballot language should provide transparency for the voter, it ends up creating confusion and misinformation. Voting “YES” for this question means that the current school funding continues without any changes. The referendum tax rate would be reduced from 22.75¢ to 19.95¢ and will not increase taxes. The effect of this ballot question is very simple – Hamilton Southeastern (HSE) Schools funding will remain stable and in 2024 the impact of the referendum to homeowner tax bills will decrease by 19.1%.

Breaking down the ballot language, the first part reads, “Shall the Hamilton Southeastern Schools continue to impose increased property taxes paid to the school corporation by homeowners and businesses for eight (8) years immediately following the holding of the referendum…” As of 2021, the Indiana legislature requires the use of this language. The word “increased” is required to be included by the legislature even though this referendum is a decrease of the existing referendum rate.

The second part reflects the purpose of the referendum funding for the next eight years:

“…for the purpose of funding academic and educationally related programs, maintaining class sizes, retaining and attracting of teachers, essential safety initiatives, and changing the previously approved maximum referendum tax rate from $0.2275 to $0.1995?” This language was written by HSE Schools based on the Revenue Spending Plan approved by the HSE Board of Trustees. School districts must review and approve a plan annually. Referendum fund spending is audited to this plan by the State Board of Accounts. The current ballot language no longer includes information about the maximum tax rate. The school included it in this section to accurately reflect the reduction of the maximum rate passed in 2016.

The next section is required by the legislature as of 2021 and does not accurately reflect the referendum tax effect. “The property tax increase requested in this referendum was originally approved by the voters in May, 2016 and if extended will increase the average property tax paid to the school corporation per year on a residence within the school corporation by 20.8% and if extended will increase the average property tax paid to the school corporation per year on a business property within the school corporation by 20.8%.”

The formula HSE Schools was required to follow for the percentages of the tax effect is not an accurate representation for several reasons. There is no information allowed on the ballot concerning the effect of the renewal of the referendum. Averages of overall taxing district rates and assessed values are distorted in the formula and are not truly representative of the taxpayer base. The actual change to the impact of the referendum to an average median value home in 2023 will decrease by 19.1%. For a home in Fishers, this represents a 2.2% reduction of their overall tax bill, not a 20.8% increase as is implied.

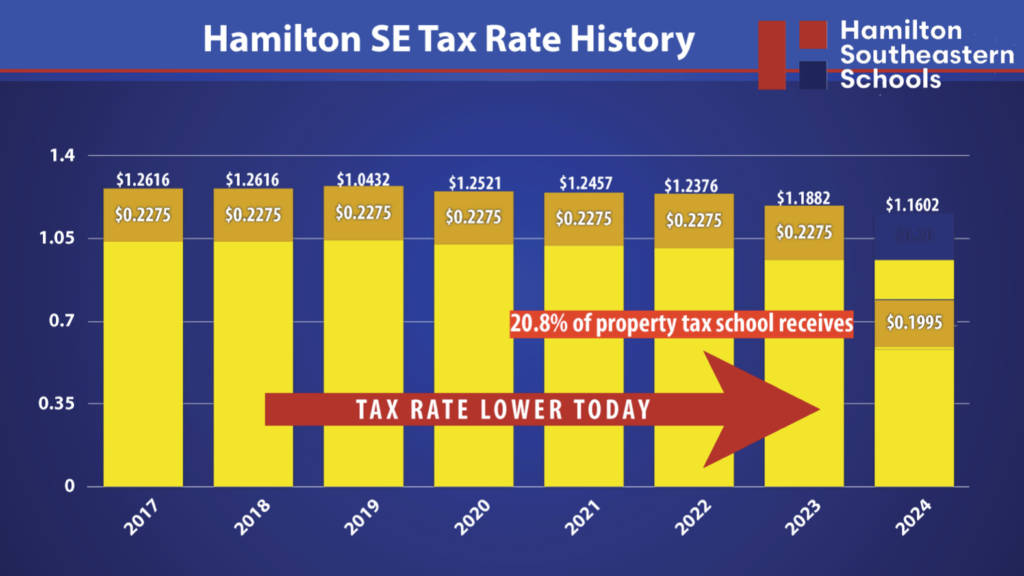

HSE Schools’ tax rate, other than the operating referendum, decreased over the last six years, as shown in this chart. The chart shows the school district was able to lower the other property taxes (Yellow) because of the flexibility provided by the referendum money (Gold). The “20.8%” in the ballot question is calculated as a percentage of the funding the school is receiving compared to the funds other than the referendum funding. It is not a 20.8% increase to the taxpayer. In 2023, the property taxes other than the referendum (Yellow) are calculated at a rate of 96.07¢. The referendum rate of 19.95¢ is 20.8% of those funds the school receives through the regular property taxes. In the chart, the referendum rate (Gold) has been moved to show it is one-fifth of the other taxes (Yellow).The actual formula required to certify the percentage in the ballot is spelled out by the Department of Local Government Finance and involves a calculation based on the mean average assessed value of a home in 2023 and an average of all the eight overall tax rates in the HSE district inclusive of all the other government entities.

Overall, the tax rate for schools is lower than it was before the referendum was passed. If the assessed value stays the same, the tax impact of the referendum will decrease between 19.1% to 12.3%, depending on increased deductions allowed by the state. However, if the assessed value goes up, the yellow portion will also drop and be less than it is now. For a commercial property in the HSE district the impact will be a reduction of 12.3%.

Only those who pay property tax in the Hamilton Southeastern Schools (HSE) district pay the referendum tax. Commercial rental property owners may choose to pass the tax on to their tenants. Senior citizens, homeowners, mortgage holders and some other types of taxpayers receive exemptions that lower their assessed value and lessen the impact of the tax rate compared to others. By law, the rate is applied to the net assessed value of the property after these deductions. The law does not exempt classes of taxpayers from the rate. For instance, charging only property taxpayers with children in the schools would be considered tuition and against the law established by the Indiana Constitution that says education is tuition free and available to all. The 2023 renewal is at a reduced rate from the 2016 referendum, meaning the referendum will not cause a tax increase but will actually cause the tax impact on homestead properties to decrease by 19.1% in 2024.

The 2023 renewal is at a reduced rate from the 2016 referendum, meaning the referendum will not cause a tax increase but will actually reduce the tax impact by 19.1% in 2024. Voting “YES”’ on the November 7 ballot question extends the stable funding Hamilton Southeastern Schools (HSE) receive for up to an additional 8 years. The referendum rate is a maximum rate and will be reviewed each year by the HSE Board of Trustees. Currently HSE Schools is the third lowest funded school district out of almost 400 traditional public schools, virtual online schools, and charter schools in Indiana. In future years, if changes are made by the Indiana state legislature to the HSE funding level, HSE can consider reductions in the rate.

The impact of the referendum is determined by the following formula:

(Gross Assessed Value – Deductions) / 100 x Operating Referendum Rate = Impact

The Operating Referendum is straightforward: the maximum rate remains consistent over the eight-year lifespan of the tax impact. You can learn more about Operating referendums and

their eight year life on the FAQ page of our website.

The maximum rate for the proposed operating referendum is $0.1995 per $100 of Net Assessed Value. Net AV is the taxable assessed value after all the taxpayer-eligible deduction have been removed. In 2023, every owner’s residence received a $45,000 homestead deduction and a 35% supplemental deduction (25% if AV is $600,000 or above) Most homeowners received a $3,000 mortgage deduction. Beginning with taxes payable in 2024, everyone will receive the $3,000 deduction as the homestead deduction increases to $48,000. Tax relief legislation passed by the legislature will raise the supplemental deduction to 40% in 2024 and 37.5% in 2025, reverting to 35% in 2026. Several other deductions may be available to taxpayers.

The school board has indicated they will evaluate the referendum rate each year to supplement the funding reductions by the State. While the rate might decrease, it will never surpass the maximum rate of $0.1995 per $100 of Net Assessed Value. Unlike all other tax rates on your bill, the referendum rate is unaffected by an increase in district assessed valuation.

The impact calculator on this website uses data from your current tax bill to determine the impact of the referendum rate. The assessed value, net assessed value, and all deductions from the current tax bills help us offer the most accurate possible property tax estimate.

The only impact to your taxes that can accurately be measured is for next year. As assessed value goes up in the district the “levy” of the the other funds is shared by more, reducing the impact to everyone. The net assessed value in Hamilton Southeastern Schools’ district went up by just 6.3% this year as opposed to the double-digit increases of the last couple years.

The Indiana Department of Local Government Finance also has a referendum calculator which might create a different estimate. The impact calculator on this website and the data file on the referendum calculator provided by the DLGF both use the same 2022 pay 2023 assessed value. However, our calculator has ALL of the deductions preloaded correctly and will present a better estimate. To determine the tax impact for your property, fill out the owner address where the tax bill is mailed and select a parcel from the results.

The tax rate is set by the Hamilton Southeastern Schools (HSE) Board of Trustees, upon a recommendation from administrators who consider the district’s financial needs. The referendum renewal is for a maximum rate of 19.95 cents, a 12.3% reduction of the rate set by referendum in 2016. The referendum funds provide greater flexibility than other property taxes generated by the school corporation. This has allowed the school to have an overall rate lower than the first year of the referendum.

If a majority of the voters oppose the operating referendum, Hamilton Southeastern Schools (HSE) will not have the funding necessary to retain teachers, keep class sizes low and provide the curriculum offerings the students need. Voters only need to look at the problems other school districts like Elkhart Community Schools have experienced after their referendum failed to renew.

The referendum accounts for approximately 14 percent of HSE Schools’ overall budget. Budget cuts would have to be made in critical areas. Without the referendum and the flexibility it provides in funding, class sizes will increase. In addition to larger class sizes this will also mean fewer opportunities for students due to less funding for academic, educational, and extracurricular programs. Voting “YES”’ means HSE Schools will continue to receive adequate, stable funding.

If the referendum does not pass on November 7, another public question on the same or substantially similar referendum may not be submitted to the voters earlier than two years after the date of the election without a petition of voters to allow it in one year. Without that petition, the earliest the referendum could be presented would be the November 2025 election. However, the Indiana General Assembly has considered legislation during recent sessions that would prevent school districts from conducting a referendum in a non- election year. If such legislation were to be passed and signed into law in an upcoming legislative session, HSE would not be able to conduct a referendum until 2026, and therefore would not receive the critical referendum funding until January 2027.

Referendum funds are used to pay for the salaries and benefits of fifty-nine classroom teachers who otherwise would have been paid for through the education fund. This allows class sizes to remain small.

When cutbacks occur in staffing due to funding shortfalls, the term “RIF” is used. This refers to Reduction-in-Force, which is based on seniority and certification. Certification is making sure teachers are certified to teach the classes and programs that will be offered the next year. For instance, if the music programs were going to be reduced, a music teacher who is not certified to teach other subjects might be more at risk of being cut. Generally, less senior teachers are reduced before a more senior teacher. However, exceptions may be made because of certification.

Reductions are based on the budget, enrollment, the schedule of classes, and rules from the Indiana Department of Education. The number of staff reductions can be potentially reduced by retirements.

If the referendum is renewed, no reductions in workforce will be necessary. If the referendum fails, reductions in force will result in larger class sizes, which, in turn, make it more difficult for students to receive the individual attention they need.

The state distributes money from revenue it collects in income tax, sales tax, gaming revenues, etc. to the almost 400 Indiana school corporations, virtual schools and charter school associations based on a funding formula the state legislature creates and passes bi-annually as part of the state budget process.

All funding issues begin with the 100 legislators in the Indiana House of Representatives. At least 85% of the revenue from the state funding formula will go in Hamilton Southeastern Schools (HSE) Education Fund beginning in 2024. About 90% of this fund pays for teachers and staff of the corporation.

The funding formula begins with a per pupil “foundation” or base amount. The foundation amount is multiplied by the “complexity index” to determine additional funding required for the education of “at-risk” children. A significant inequity in the funding formula occurs when the money for an at-risk student does not follow the child to another school district. For example, the top funded districts in the state receive over $2,000 extra for each at-risk student. When these same students move to HSE, the extra dollars do not follow those students.

There are additional funding formula inequities that must also be considered related to achievement scores. There are no significant adjustments to the funding formula for a school corporation based upon achievement scores. There is also no accountability for achievement results from those school corporations and charter school associations with higher levels of at-risk students from the additional money they generated. While Indiana legislators have considered merit pay as a reward for individual teachers who improve their students’ achievement results, these discussions often overlook the crucial need for adjusting the school-wide funding formula based on overall achievement scores.

Since the 2008 Property Tax Reform legislation, there has been a continuing decline in school funding when adjusted for inflation. This has exacerbated the inequities in the funding formula, creating a serious school funding crisis. As it stands, the state funding – based solely on the General Assembly’s formula – is now the only source of funding available for classroom instruction. Since 2008, the legislature has considered possible adjustments, such as modifying the base funding amount, incorporating an index for academic outcomes, and making other minor alterations to the formula. However, any changes that do occur are likely to be implemented slowly over the coming years, if they happen at all.

The legislature addressed some of these concerns in the 2022 legislative session. School districts in Indiana received new money from the state this year and HSE is appreciative of the increase. However, even with this percentage increase, when adjusting for inflation HSE is receiving approximately 40 million dollars less compared to the funding it received from the state in 2009.

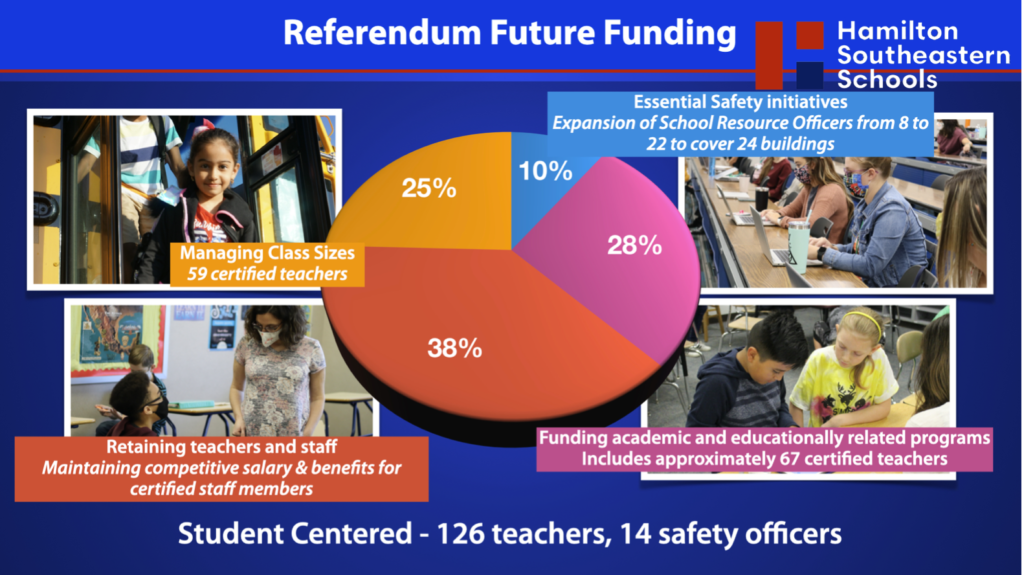

This pie chart shows the Revenue Spending Plan filed with the Department of Local Government Finance. This Revenue Spending Plan is reviewed and filed yearly by the Hamilton Southeastern Schools (HSE) Board of Trustees, ensuring alignment with the purpose stated on the ballot. The ballot proposes the use of funds for academic and educationally related programs, maintaining class sizes, retaining and attracting teachers, supporting essential safety initiatives, and adjusting the previously approved maximum referendum tax rate from $0.2275 to $0.1995. The school is audited by the State Board of Accounts to ensure spending follows this revenue spending plan.

HSE Schools will not be able to maintain their current academic, co- and extra-curricular programs unless we “Vote YES” to continue the current funding. Without continued funding, HSE Schools risks losing critical staff positions, increasing class sizes and a reduction of student opportunities.

However, the majority of the funding – over three-quarters of it – will be used to manage class sizes and retain teachers and staff. The renewed referendum would retain 126 full-time teachers and support incentives, and provide competitive raises and benefits for almost 1,400 teachers, a critical segment in our school system.

By state law, school districts can’t use other school funds (Debt Service, Transportation, Capital Projects Funds) to pay Education Fund expenses such as salaries. For example, money used to build buildings cannot be used for teacher salaries and instructional supplies. No teaching positions have been lost because of past or current building projects.

These laws also limit creative funding reduction ideas like four-day school weeks, cutting transportation to save teachers, changes in food service, charging parents tuition, and more.

Hamilton Southeastern Schools’ (HSE) 2023 estimated impact is a $4 million loss from its budget due to the state’s constitutional circuit breaker “claw-back,” also known as property tax caps. The majority of homeowners in the HSE district receive a credit due to property tax caps that limit the regular property taxes to 1% of the assessed value of a home. The 2023 total property tax bill for a home with a median value of $319,500 in Fishers would be $3,963 without the property tax caps. The cap limits the regular property taxes to $3,195 for this homeowner. The reduction (referred to as a “circuit-breaker credit”) is funded by a reduction in local government budgets, including the HSE Schools’ budget. Property taxes approved by the voters, such as the 2016 HSE Schools referendum, are not subject to property tax caps.

Indiana law does not allow school corporations to advocate for a referendum once it has been placed on the ballot by the school board. Information and communication about the referendum from that point must come from a source independent of the school corporation, such as a group led by community members.

In addition, school employees with a few exceptions (e.g. superintendent, assistant superintendents, and chief financial officer) cannot advocate for the referendum during regular school hours “while they are on the clock”; however, before and after school, HSE staff members are like anyone else and can advocate for the referendum on their own time.

Advance HSE – made up of committed community and parent volunteers – has been formed to guide this campaign process. Community members have signed up to volunteer for this effort and more are needed to help with the referendum. Advance HSE officers include Co-Chairpersons Sneha Shah and Laura Smoots.

In order to fund the campaign, including yard signs, brochures and this website, Advance HSE must raise money from sources outside of the school corporation funds. Donations can be made with a credit or debit card here.

Check back for more FAQ’s in the coming days